Intouch Credit Union - Your Financial Friend

Finding a place that truly understands your money needs can, you know, sometimes feel like a bit of a search. Many people are looking for somewhere reliable, somewhere that feels like it’s genuinely on their side when it comes to managing personal funds or even business finances. That’s where a name like intouch credit union often comes up. They offer a selection of helpful ways to manage your money, whether you're saving up for something special, handling everyday spending, or looking for a little extra support with a loan. It's all about making your financial life a bit smoother, actually.

This particular credit union, you see, seems to be a really good choice for folks across a few different areas. If you happen to be in Texas, or maybe out in Las Vegas, or even up in Michigan, they’ve got options that could fit what you’re looking for. From setting aside money for the future to getting a loan for a big purchase or a business venture, they aim to be a helpful spot for all sorts of financial happenings. It's pretty straightforward, too, when you consider what they offer.

Beyond just the basic services, they also make it quite simple to keep an eye on your money from wherever you are. You can get into your account online, which is very convenient for paying bills and keeping tabs on things without having to go anywhere. So, whether you’re thinking about putting some money away, getting a new way to pay for things, or perhaps need some financial backing, intouch credit union presents itself as a friendly face in the world of personal and business money management.

Table of Contents

- What Makes intouch credit union a Good Choice?

- How Can intouch credit union Help with Your Daily Money Needs?

- Where Can You Find intouch credit union?

- How Do I Get in Touch with intouch credit union in Plano, TX?

- What Kind of Info Can You Get About intouch credit union Locations?

- When Did intouch credit union Begin Helping People?

- Who Was intouch credit union Originally There For?

- Is Finding an intouch credit union Spot Close to You Simple?

What Makes intouch credit union a Good Choice?

When you’re thinking about where to keep your money or get financial help, it’s only natural to want a place that feels right, isn't it? intouch credit union, it seems, positions itself as a really solid pick for a few key reasons. They offer a set of services that many people look for, whether it's a spot to put your extra cash, a way to handle your everyday spending, or perhaps some financial backing for bigger plans. They’re available in Texas, Las Vegas, and Michigan, which means they reach a pretty wide group of people, actually.

The idea of a credit union, as you know, is a bit different from a regular bank. It’s more about the people who are part of it, the members, rather than just making profits for shareholders. This often translates into a more personal touch and, in some respects, perhaps better rates on things like savings or loans. So, when intouch credit union says they are a good option, it’s probably because they focus on helping their members achieve their financial aims, which is pretty important, I mean.

They’ve got the basics covered, too, like places to put your money for later, which are usually called savings accounts. These are super helpful for building up a nest egg, whether it’s for a rainy day or a big purchase down the line. Then there are the everyday money accounts, the ones you use for paying bills and getting your paycheck, which are very essential for daily life. And for those bigger dreams or business needs, they also provide different kinds of loans, which can really help get things moving, you know.

How Can intouch credit union Help with Your Daily Money Needs?

Managing your money every single day can sometimes feel like a juggling act, can’t it? You’ve got bills to pay, groceries to buy, and perhaps a bit of fun money to set aside. intouch credit union, it appears, offers ways to make this daily money management a good deal simpler. They provide what are commonly known as checking accounts, which are your go-to for regular spending and income. These accounts are, you know, basically your financial hub for daily transactions.

Beyond just having a spot for your daily funds, they also make it easy to actually use that money for things like paying your monthly bills. You can, apparently, log into your account right on the intouch credit union website and get those payments sorted online. This kind of access is really quite handy, meaning you don't have to write checks or send things through the mail. It saves time and, in a way, gives you more control over your spending from the comfort of your own home, or wherever you happen to be.

And it’s not just about spending, either. They also have places where you can put money away for the future, which are often called savings accounts. These are quite useful for building up a financial cushion or for reaching a specific financial target, like buying a home or taking a special trip. So, whether you’re dealing with the present or planning for what’s ahead, intouch credit union aims to provide tools that make your financial life a little less complicated, which is nice, isn't it?

Where Can You Find intouch credit union?

Knowing where a financial institution has its physical spots can be pretty important for a lot of people, especially if you like to handle things in person every now and then. intouch credit union, it seems, has a presence in a few different states. They have places where you can visit them in Texas, which is a big state, as you know. They also have locations out in Las Vegas, Nevada, and up in Michigan. This spread suggests they serve a rather broad group of people across these areas.

For folks living in these states, having a local spot for their money needs can be a real comfort. It means you can go in and talk to someone face-to-face if you have a question, or if you need to do something that’s easier to handle in person, like getting a cashier’s check or sorting out a specific loan detail. So, it's not just about online access; there are actual physical places you can go, which is quite reassuring for many, I mean.

Specifically, if you're in Plano, Texas, intouch credit union has a good number of spots there. The information mentions that there are five different branch locations right within Plano. This kind of local presence means that if you live or work in that area, you’re likely to have an intouch credit union branch fairly close by, making it pretty convenient for your banking needs, which is always a plus, isn't it?

How Do I Get in Touch with intouch credit union in Plano, TX?

Sometimes, you just need to talk to a person, don’t you? Whether it’s a quick question about your account or something a bit more involved, getting in touch with customer service is often the next step. If you’re looking to speak with someone from intouch credit union specifically in Plano, Texas, the information suggests that reaching their customer service there is a clear process. You'd be looking for the contact details for their Plano, TX operations.

While the exact phone number isn’t given in the initial text, it does make it clear that finding a way to connect with them is part of the information they provide. This usually means checking their official website or perhaps a local listing. The fact that they have five different branch locations in Plano, TX, suggests there are multiple points of contact, which is very helpful, you know. Each of these spots would, typically, have its own phone number or a general customer service line for the area.

So, if you’re wondering how to get answers about your intouch credit union account or services in Plano, TX, the best approach would be to look for their contact information related to those specific branches. It’s pretty common for credit unions to have dedicated lines for their local members, making it easier to get the help you need without too much fuss, which is nice, I mean.

What Kind of Info Can You Get About intouch credit union Locations?

When you’re trying to visit a physical location, having all the right details beforehand can save you a lot of time and bother, can’t it? For intouch credit union, it seems they make it pretty simple to get the rundown on their various spots. The information available about their branches includes things like their operating hours, which is quite important so you don't show up when they're closed. You can also find their phone numbers, which is handy if you want to call ahead with a question.

Beyond just the basics, they also provide other useful pieces of information. This might include, for example, reviews from other people who have used their services, which can give you a bit of a feel for what to expect. You can also find their routing numbers, which are those special codes you need for things like setting up direct deposits or making online payments. So, it's pretty comprehensive, meaning you should have all the details you need before you even head out the door, which is very convenient, you know.

All this information, it appears, is gathered together in one place, making it easy to look up. So, if you’re trying to find the nearest intouch credit union branch, you won’t have to hunt around too much. It’s all laid out for you, which makes planning your visit or just getting the info you need a good deal simpler. This kind of transparency is, in some respects, a sign of a place that wants to make things easy for its members, isn't it?

When Did intouch credit union Begin Helping People?

Every organization has a starting point, a moment when it first opened its doors and began its work. For intouch credit union, their story of helping people with their money goes back quite a way, actually. They were first given their charter, which is like their official permission to operate, way back in 1974. That means they’ve been around for many decades, providing financial services to people for a very long time, which is quite a history, isn't it?

Starting in 1974, they have, you know, accumulated a good deal of experience in the world of personal finance. This long stretch of time suggests a certain level of stability and a deep understanding of what people need when it comes to managing their funds. It’s not a new kid on the block; it’s a place that has seen many changes in the financial landscape and continued to serve its members through it all, which is pretty impressive, I mean.

This long history also speaks to their commitment to the people they serve. To stay in business for so many years, a credit union really has to build trust and provide services that genuinely help its members. So, when you consider intouch credit union, you're looking at an institution with a solid foundation built over nearly half a century, which is, in some respects, a very comforting thought for anyone looking for a reliable financial partner.

Who Was intouch credit union Originally There For?

It’s quite common for credit unions to start out serving a particular group of people, and intouch credit union is no different in that regard. When they first got their charter in 1974, they weren't, you know, open to just everyone right away. Their initial purpose was to serve the employees of a specific company called Electronic Data Systems, or EDS for short. This focus meant they were initially set up to help the folks who worked at EDS in the Dallas area.

This kind of origin story is actually pretty typical for credit unions. They often begin within a company, a community, or a specific industry, creating a financial cooperative for people who share a common bond. For intouch credit union, that bond was working at EDS. This means they likely had a deep understanding of the financial needs and situations of those employees, which could have helped them offer very specific and helpful services to that group, you know.

Over time, many credit unions expand their membership beyond their original group, and it seems intouch credit union has done just that, now serving a broader public in Texas, Las Vegas, and Michigan. But knowing their starting point, serving EDS employees in Dallas, gives you a bit of insight into their roots and how they likely developed a strong sense of community and member focus from the very beginning, which is, in a way, a nice part of their story.

Is Finding an intouch credit union Spot Close to You Simple?

When you need to visit a branch, whether it's for a quick transaction or a more detailed conversation, it’s always a relief if finding the place is straightforward, isn’t it? For intouch credit union, it seems they’ve made it quite easy to locate a branch that’s convenient for you. The information indicates that if you’re looking for the closest intouch credit union branch, all the details you need are available in one spot.

This means you won’t have to spend a lot of time searching different websites or making multiple phone calls to figure out where to go. All the location information, which includes things like addresses, hours of operation, and contact numbers, is, apparently, presented on a single page. This kind of organized approach really helps when you’re on the go or just trying to plan your day, which is very helpful, you know.

So, whether you're in Texas, Las Vegas, or Michigan, and you're wondering where the nearest intouch credit union is, you can feel pretty confident that the information you need to find them is readily available. It’s all about making things simple for the people who choose to do their banking with them, ensuring that getting to a physical spot is just as easy as managing your money online, which is, in some respects, a good sign of a customer-focused approach.

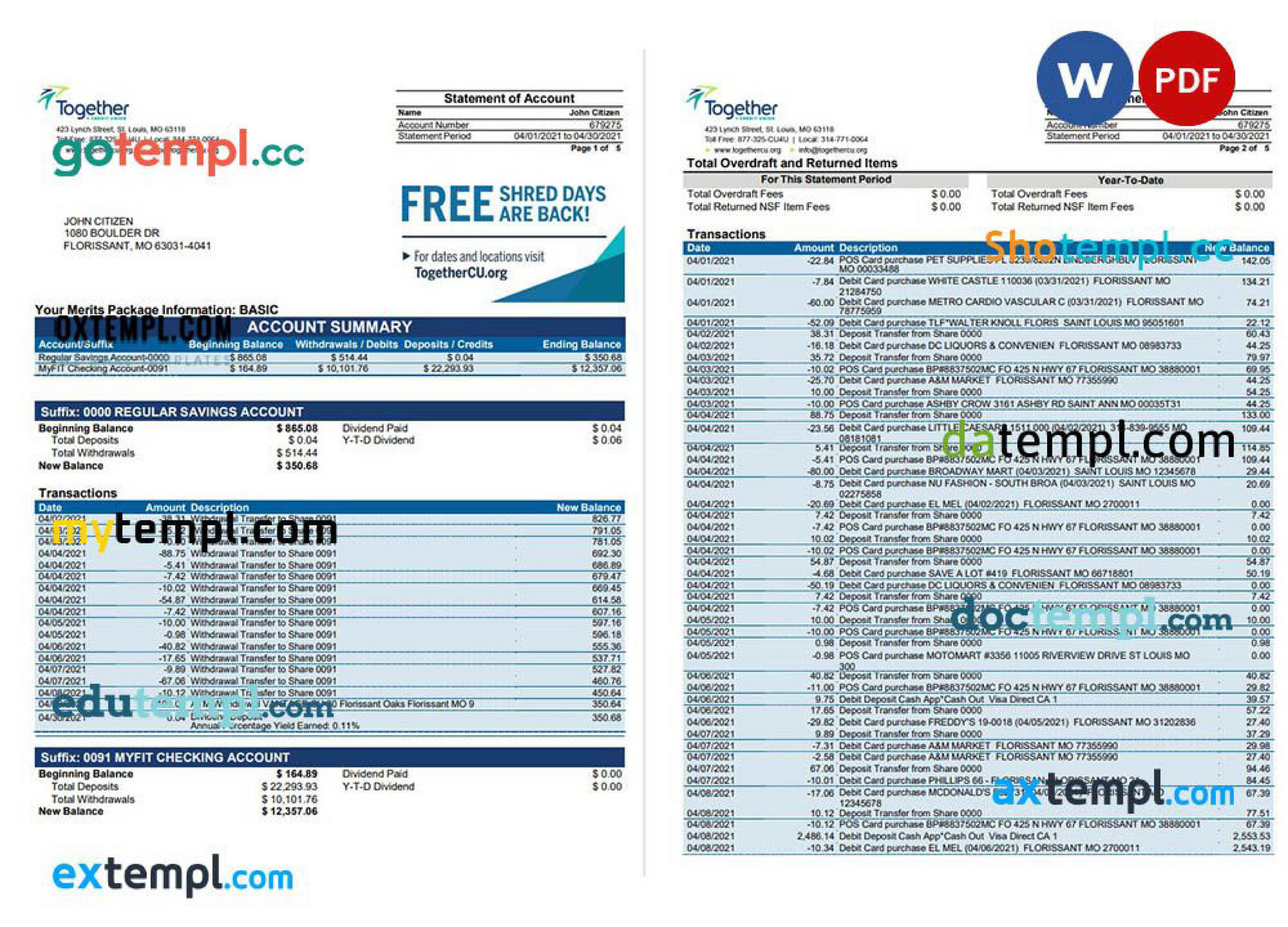

Doctempl - USA Missouri Together Credit Union bank statement template

InTouch Credit Union

InTouch Credit Union